Lloyds Banking Group has revealed a fresh £700m provision for bad loans in the tough economy but raised dividends to shareholders on the back of rising profits.

Britain’s biggest mortgage lender, which also includes the Halifax, Bank of Scotland and Scottish Widows brands, reported pre-tax profits of £3.9bn for the six months to June.

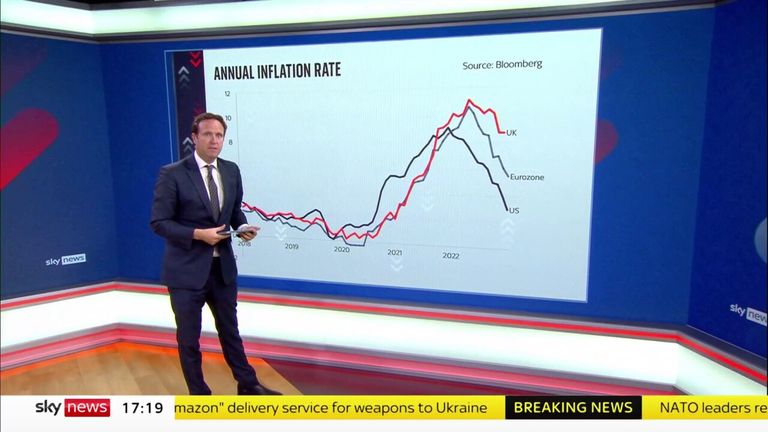

That was up on the £3.1bn achieved in the same period last year as it benefited from higher interest rates imposed on customers due to Bank of England action versus inflation.

Lloyds said that while it had set aside more cash – on top of £1.5bn last year, to cover the cost of loan defaults, it was proactively working with customers to manage their obligations and help those with savings to get the best rates.

Lloyds is the first of the so-called big lenders to update the City on their progress during 2023.

Barclays and NatWest – the latter currently gripped by the departure of its chief executive over her handling of the Nigel Farage de-banking row – will report on Thursday and Friday respectively.

It is the sector’s final set of results before a new rule on customer service comes into force.

The so-called consumer duty, which kicks in from Monday, requires all firms regulated by the Financial Conduct Authority (FCA) to demonstrate how they ensure good outcomes for customers, including helpful and responsive customer service, useful communications, and fair value for money on products.

There are mounting concerns that the evolving cost of living crisis, exacerbated by the effects of rising interest rates, will prove more damaging this coming winter due to the toll already inflicted on household budgets.

The FCA told firms just on Tuesday they must improve how they interact with customers to offer help faster.

It was a reaction to the watchdog’s latest Financial Lives survey which found that 7.4 million people unsuccessfully tried contacting their financial services providers during the 12 months to May 2022.

Amid criticism of poor instant access savings rates among the main lenders, Lloyds said it had contacted over 10 million customers about their savings options, with 1.9 million new savings accounts opened during the first six months of the year.

Lloyds said it was proactively contacting customers to offer cost of living support, including more than 200,000 mortgage customers, alongside its commitment to the government’s Mortgage Charter that offers reduced monthly repayment options.

It added that it was in contact with more than 550,000 business customers to offer guidance on “building financial resilience”.

Shares fell by almost 4% at the open despite an improved interim ordinary dividend of 0.92 pence per share, up 15% on the prior year and equivalent to returning £594m to shareholders.