Wage rises have slowed, official figures show, potentially signalling good news for those hoping for a fall in the cost of borrowing.

But pay has increased faster than the overall rate of price rises.

Money latest – We tried the UK’s cheapest three-course dinner* – here’s what you get for £5

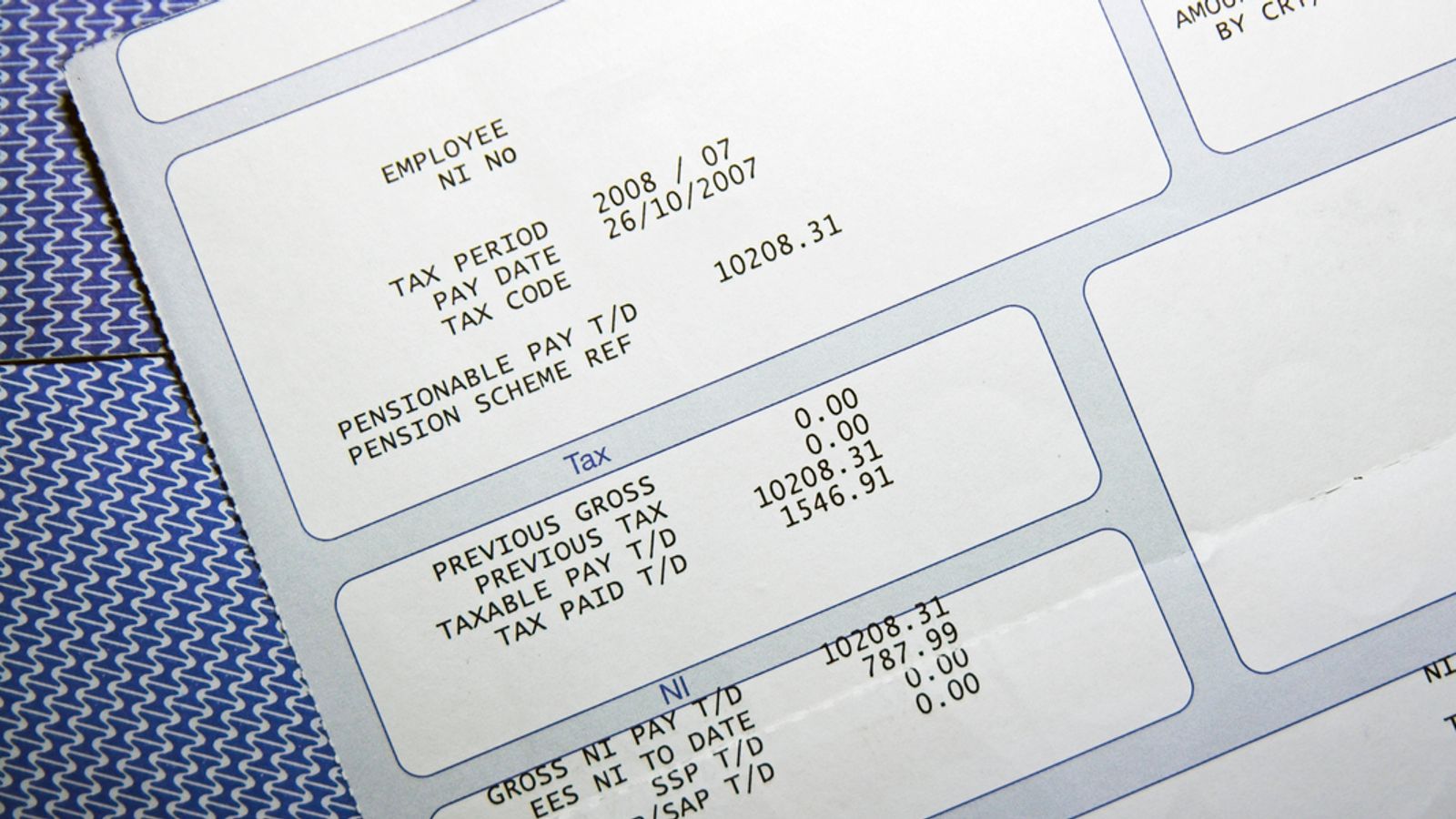

Earnings rose at an annual rate of 5.7% in the three months to May, data from the Office for National Statistics (ONS) showed.

In the same month, inflation stood at 2%. Because of reduced inflation and pay rises remaining high, the ONS said real wages – which adjust for inflation – grew at the fastest rate in nearly three years, 3.2%.

The figures are in line with economists and Bank of England forecasts so could help rate-setters at the Bank decide to cut in August.

Acting to keep the interest rate the same, however, is inflation data released on Wednesday which showed stubbornly high prices in parts of the economy

Who cares about wages – other than employees?

Wage data is a particular area of focus for the Bank, especially as employment data from the ONS has been unreliable in recent months.

The statistics agency has changed how it calculates labour market numbers due to the low take-up of their previous surveys.

Today’s numbers will also have been impacted by the 9.8% minimum wage rise which came into effect in April.

The increase is likely to have only taken effect later in the month at some companies and it will have influenced May figures as a result.

There was no change in the rate of unemployment which remained at 4.4%.

“We continue to see overall some signs of a cooling in the labour market, with the growth in the number of employees on the payroll weakening over the medium term and unemployment gradually increasing,” the ONS said,

“The number of job vacancies is down across most sectors, led by retail and hospitality. The total has now been falling for a full two years, though it remains above pre-pandemic levels.”