Behind almost every purchase you make, from Christmas lights to a new car, there is a ship.

Almost everything we buy, use, wear, and much of what we eat, spends at least some of its life in a container at sea.

These giant craft are the lifeblood of the global economy, circumnavigating the globe to meet consumer demand, transporting raw materials from the US and Europe to Asia, and finished goods in the other direction, often starting in the mega ports of Shanghai and Singapore.

It’s also how oil and gas gets from where it’s sourced to where it’s needed, be it crude from the Gulf or liquid natural gas from Australia.

Follow war latest:

British ship among those attacked

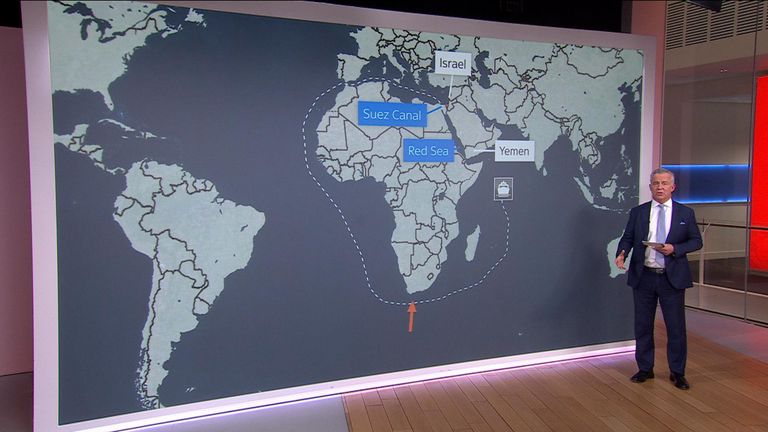

And around 10% of all that trade passes through the Red Sea, the route to and from the Suez Canal, the crucial artery that knocks up to a fortnight off the journey from the Indian Ocean to the Mediterranean.

That is why the decisions by major shipping companies to cease sailing through the Red Sea, and BP’s decision to send its oil tankers the long way round too, matters.

The cessation comes after weeks of attacks launched from Yemen, on the eastern shore at the Red Sea’s narrowest point, the Bab al Mandab Strait.

Just 20 miles wide, it is a pinch point from which militants have targeted – what they claim – is freight bound to and from Israel.

They have been able to do this despite the presence of American, British, French and other naval vessels in the Red Sea, in part to secure commercial shipping.

The US and Royal Navy say they have intercepted rocket attacks over the weekend but that has not been enough to reassure companies, and crucially their insurers, that it is safe to run the risk of the Red Sea.

The danger from an economic standpoint is that we may be at the start of a prolonged period of disruption.

German giant Hapag-Lloyd told Sky News on Monday it will not resume using the Red Sea until the New Year at the earliest, and only then when it is assured that it is safe.

Given the volatility of the region and the firepower available to the Houthis that will not be straightforward, and we may be seeing the first genuine economic contagion of the Gaza conflict.

From the moment Hamas launched its attacks, there have been concerns that a wider regional conflict could be damaging, beyond the obvious human price, but so far that has not materialised.

The oil price, for example, has been largely stable despite crucial Gulf actors having an interest in the region but that might now change.

A few days of disruption would not be disastrous to global supply chains but a few weeks is another matter.

The blocking of the Suez Canal by the grounded mega ship the Ever Given in March 2021 caused chaos, and while global demand for shipping is much lower today, no one will welcome the inflationary pressure of increased shipping costs.