How to sum up a year like 2023?

Perhaps the best thing to say is that it was considerably less exciting – as far as the economics went – than 2022.

And that’s probably no bad thing, because in 2022 much of what passed for excitement was extremely painful: the onset of a cost of living crisis which caused the biggest fall in British standards of living in modern record, a financial meltdown in the wake of Liz Truss‘s mini-budget.

The plan, when Rishi Sunak and Jeremy Hunt came into office, was always to make the economy boring again, and to some extent they succeeded.

Most obviously, while the government’s cost of borrowing did later rise to above the Truss era levels, it was largely down to higher inflation expectations and not to fears over the credibility of UK government policy.

This time last year, most people assumed – present company included – that 2023 would be a year of recession for the UK.

And for much of the year that’s precisely what it looked like.

France and Germany both tipped into technical recession (the definition of which is that you suffer two successive quarters of economic contraction). The UK was expected to do likewise.

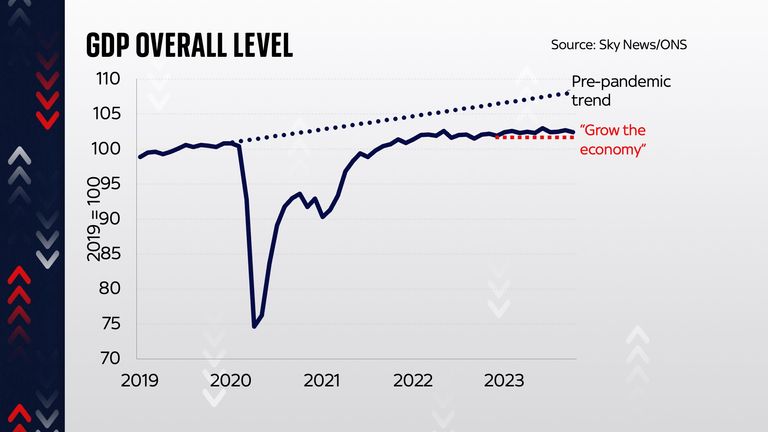

Economic growth

But somehow, it never happened.

At least, not quite.

Instead, the economy more or less flatlined for most of the year – though figures published by the Office for National Statistics just before Christmas showed the economy contracted slightly, by 0.1% in the third quarter.

Either way, this can hardly be held up as a positive result. Normally you’d expect the UK’s gross domestic product to grow by around 2-2.5% each year.

However, a negligible amount of economic growth is more than most expected this year – even if (see below) it was helped by a colossal increase in migration.

Technically, this meant the prime minister met one of his much-publicised pledges he made to the country at the start of the year – to grow the economy.

As you can see from the chart, this isn’t much to boast about, especially set against the pre-pandemic path, but it is certainly better than what many other European countries experienced.

The Cost of Living

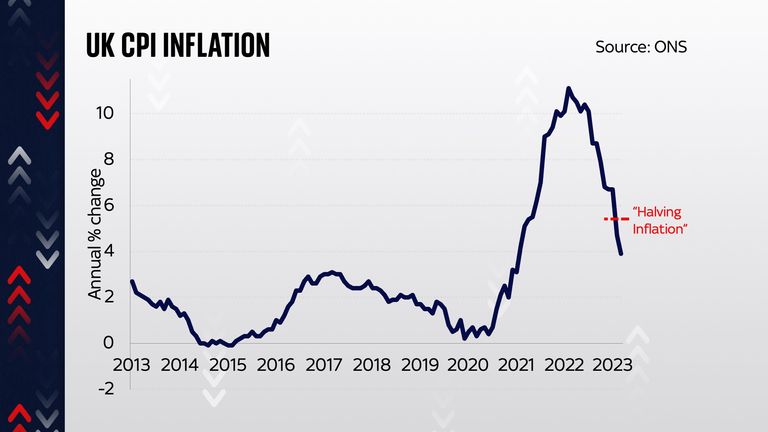

Another of the prime minister’s pledges was to halve inflation this year.

At the time he made it, this pledge looked pretty unspectacular, given a) controlling inflation is the Bank of England‘s task, not the government’s and, anyway, b) pretty much every economist was expecting inflation to halve this year anyway.

But over the course of the year inflation defied many of those economists’ forecasts, with the upshot that by the summer that pledge looked quite risky.

But then, no sooner had inflation surprised on the upside, it surprised on the downside, falling faster than most economists expected.

By the end of the year the consumer price index rate of inflation was down to 3.9% which is nearly in “normal” territory, albeit considerably higher than the Bank of England’s 2% target.

But while that meant the rate was indeed halved (actually more than halved) over the year, this hardly ends the cost of living crisis.

After all, inflation is simply the rate at which prices are changing each year. And right now prices are still 15% higher than they were a couple of years ago.

It’s that jump in levels which is causing severe economic hardship right now.

Life is not getting any less expensive. It’s just getting expensive a little slower than it was a year or so ago.

Interest rates

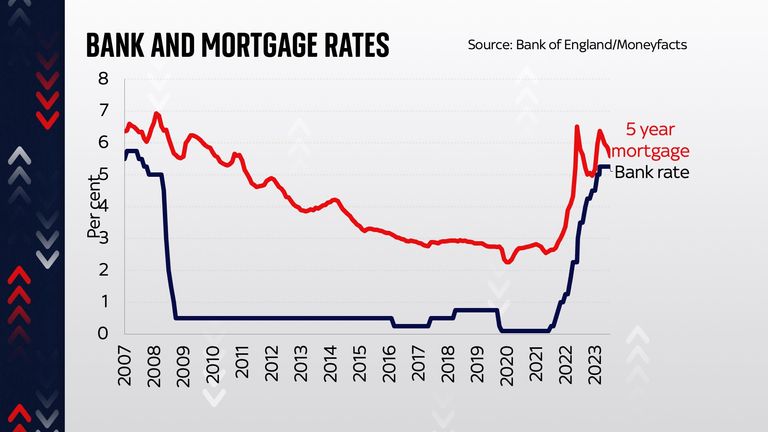

It’s tempting to lump interest rates along with the other things that didn’t turn out as bad as expected, but here the story is more complicated.

True: rates never rose to the 6% highs that were once expected around the time of the Truss mini-budget and also during the inflation spike during the Hunt chancellorship.

But they nonetheless rose far higher than most had expected at the start of the year, up to a peak of 5.25%. As the year ended, the Bank was still insisting that they would stay up there for some time (and some members were still voting for higher rates) but most investors believe they will be cut numerous times in the new year – down as far as 4% by the end of the year.

That has a bearing on the mortgage rates most of us pay, since fixed-rate mortgages are mostly priced off what’s going on in financial markets rather than the Bank’s official rate. The upshot was that the going rate for two and five-year fixed-rate mortgages were falling sharply by the end of the year.

Tax burden

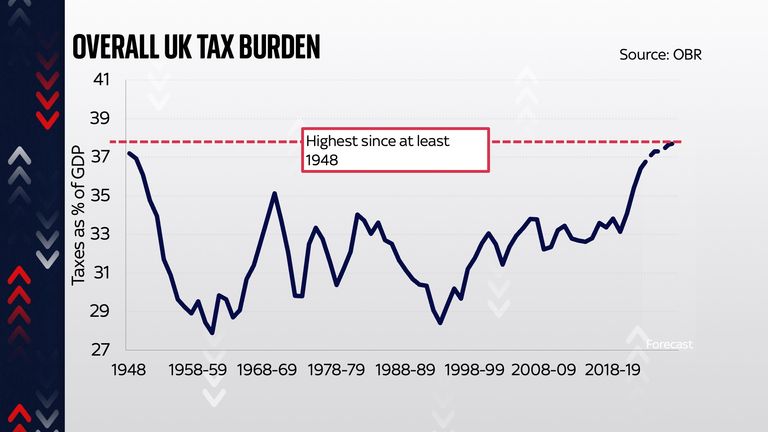

Another hot topic this year was taxation.

The government insisted repeatedly that it wants to bring it down, and in the Autumn Statement, the chancellor announced a series of cuts to both workers’ taxes and taxes on business investment.

The upshot was that the tax burden wasn’t due to rise as high as it might otherwise have done.

However, the overall burden is still due to hit the highest level since the 1940s, in large part because of the fact that the levels at which people are pulled into higher tax bands has been frozen.

Higher wage inflation (due to the cost of living crisis) means more people are seeing their earnings taxed at those higher levels.

This so-called “fiscal drag” means the nation is shifting from being a medium-tax country to a high-tax country.

But so too are most developed nations, as the cost of running expensive healthcare systems rises, along with the average age of their populations.

Migration

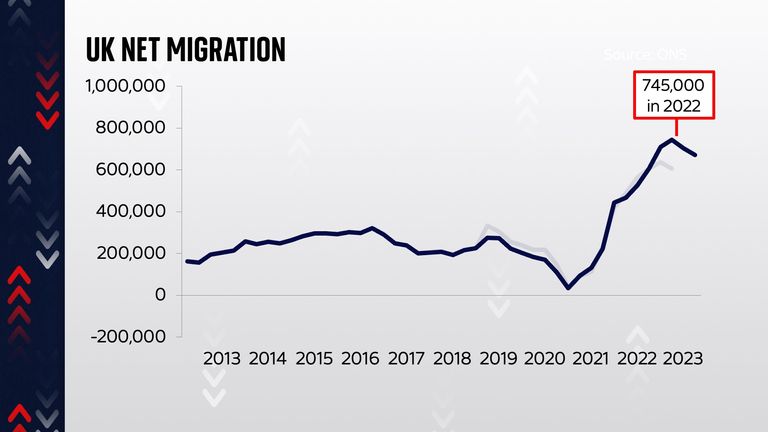

While the government spent much of its energy talking about illegal immigration and the boats coming across the channel, the real quantitative story here was actually legal migration, which rose, according to the data released this year, to an unprecedented level of 745,000 in 2022.

That rise was extraordinary by any standards.

When looked at as a share of the population, it amounts to comfortably the biggest rise in net migration since records began. And, strikingly, experts said that this was primarily a consequence of the new rules brought in after Brexit, which made it easier for workers and students from outside Europe to come to Britain.

Migration might have been a big issue during the EU referendum, but the numbers today are considerably higher than they were back then – but Britain has swapped EU migrants with those from outside the continent – primarily from India and China.