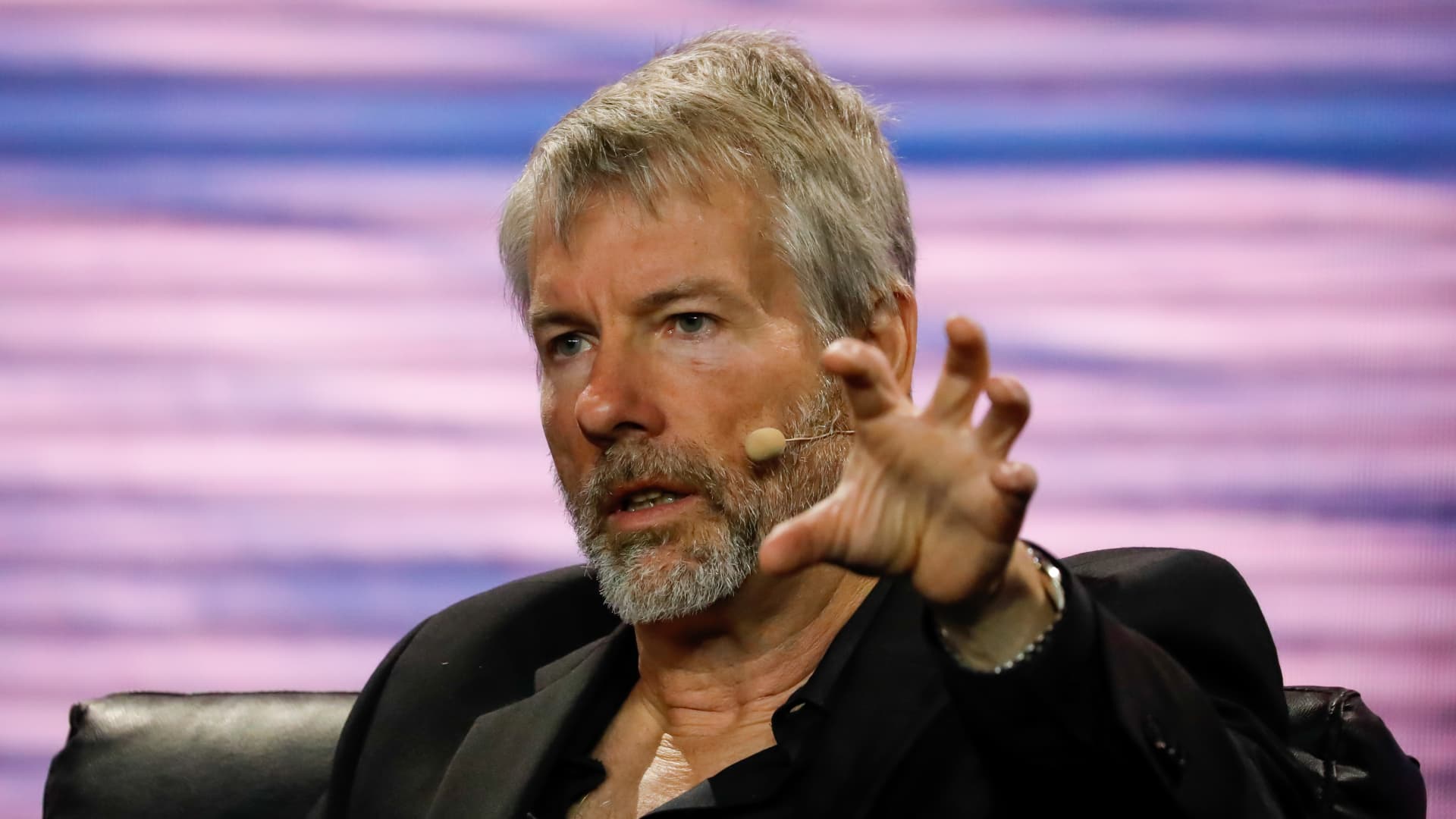

When MicroStrategy’s Michael Saylor came on CNBC’s “Closing Bell: Overtime” in December to talk about crypto, he said “the one thing we can count on is bitcoin goes forward in the year 2024, and a strategy built around bitcoin is generally a pretty safe one for institutions.”

While the long-term safety of bitcoin may still be up for debate, Saylor’s strategy has been a hugely lucrative one, particularly this week.

Shares of MicroStrategy, which derives the vast majority of its value from its bitcoin holdings, jumped 10% on Wednesday, bringing its three-day rally to 40%. Saylor is MicroStrategy’s biggest investor, with a 12% stake in the company. He also disclosed in 2020 personal ownership of 17,732 bitcoins.

Add it up and Saylor is about $700 million richer than he was on Sunday.

Between Saylor’s MicroStrategy control and his bitcoin, his holdings climbed to $2.96 billion in value on Wednesday from $2.27 billion the start of the week.

A MicroStrategy spokesperson said the company doesn’t comment on Saylor’s personal finances.

The big catalyst this week has been bitcoin’s rally to its highest level since November 2021. The digital currency rose as high as about $64,000 on Wednesday, up from $51,500 early Monday. It pulled back to around $60,000 later in the day after Coinbase’s app suffered glitches that led many users to see a balance of zero in their accounts.

Saylor, who founded MicroStrategy in 1989 and remains the company’s chairman, is one of bitcoin’s principal evangelists, co-authoring a book about the cryptocurrency in 2023 titled “What is Money?”

MicroStategy has a business in enterprise software and cloud-based services, but its bitcoin ownership effectively makes the company a proxy for the world’s biggest cryptocurrency.

The company said on Monday that it acquired an additional 3,000 bitcoins for a total of $155 million between Feb. 15 and Feb. 25. MicroStrategy, along with its subsidiaries, now owns about 193,000 bitcoins worth close to $12 billion.

MicroStrategy announced its plan to invest in bitcoin in mid-2020, disclosing in an earnings call that it would commit $250 million over the next 12 months to “one or more alternative assets,” which could include digital currencies like bitcoin. At the time, the company’s market cap was about $1.1 billion. It’s now worth over $16 billion.

During MicroStrategy’s latest earnings call on Feb. 7, CFO Andrew King said the company is “the largest corporate holder of bitcoin in the world, and we have remained committed to our bitcoin acquisition strategy with the highest conviction.”

MicroStrategy shares are now up 52% for the year after soaring 346% in 2023.

WATCH: MicroStrategy’s CEO talks Bitcoin’s price passing $50,000